Follow us on

What is the future of commercial real estate? Who is visiting shopping centres today, and why?

These questions have become central for retailers, landlords, investors and asset managers navigating a profoundly transformed market.

According to Knight Frank’s Global Property Market Insight, European markets remain among the largest sources of cross-border capital, driven by investment managers, institutions and private equity funds. However, the challenge is no longer just where capital is flowing, but how investment decisions are made in a context defined by hybrid work, evolving consumer habits and increasingly selective footfall recovery.

In this new landscape, traditional indicators such as demographics or historical performance are no longer sufficient. Understanding real visitor behaviour, who comes, how often, for how long, and for what purpose, has become a key differentiator for identifying resilient assets, optimising tenant mixes and anticipating demand. This is where mobility data is reshaping how commercial real estate decisions are made.

Changing the game with visitor insights

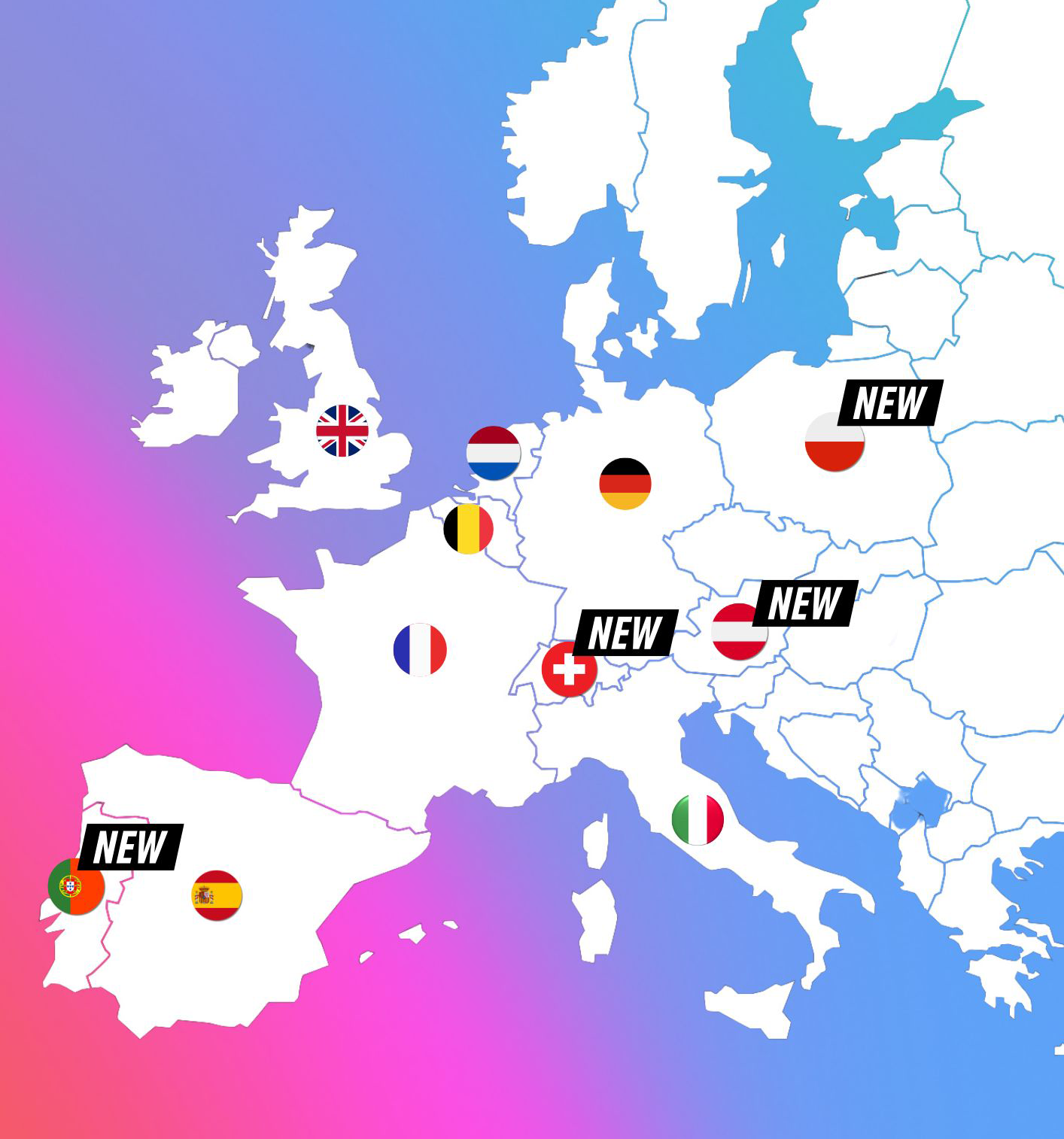

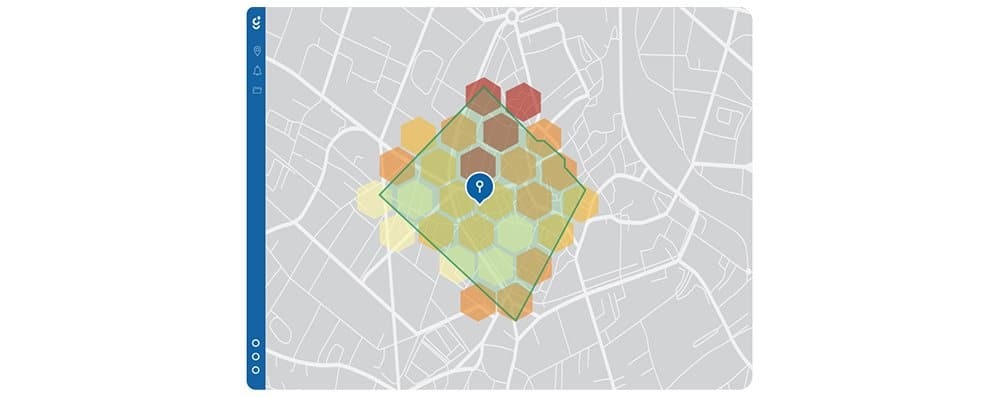

Visitor behaviour is no longer a black box. With advanced location intelligence tools such as Geoblink by MyTraffic, retailers and real estate players can now access a clear, dynamic view of how people interact with any commercial area.

Visitor Insights allows users to analyse who is visiting a specific location, where those visitors come from, where they live and work, and how they behave before, during and after their visit. This analysis can be applied not only to owned assets, but also to surrounding areas and competing locations—particularly relevant for shopping centres, retail parks and high-street environments.

Rather than relying on assumptions, this approach helps decision-makers identify their true catchment areas, understand the detailed profiles of their visitors and track how these patterns evolve over time. It also provides valuable answers to strategic questions such as:

- How far visitors are willing to travel

- Whether visits are becoming more or less frequent

- How marketing reach should be defined

- How competition is impacting footfall distribution

By applying big data techniques and advanced analytics, fully anonymised GPS data is transformed into highly granular mobility insights, updated weekly and available down to the hourly level. The result is a continuously refreshed understanding of visitor behaviour that reflects real-world usage, not static snapshots.

Why monitoring visitor behaviour is now critical

In today’s commercial real estate environment, understanding visitor behaviour is no longer a “nice to have”, it is essential. Changes in working patterns, lifestyle habits and consumption rhythms have fundamentally altered when, why and how people visit commercial spaces.

Key questions now go far beyond simple footfall counts, focusing instead on the primary purpose of visits, whether shopping, work, leisure or services, how visit patterns have evolved compared to six months or a year ago, whether catchment areas are expanding, contracting or shifting, how assets or stores within a network may be cannibalising each other, and which competing brands visitors are also frequenting.

Having clear answers to these questions allows retailers and real estate players to move from reactive decisions to proactive strategies. Visitor insights reveal not only how often people visit an area, but also how long they stay, crucial information for optimising store formats, tenant mixes, opening hours, staffing levels and even future asset acquisitions.

In a market where performance gaps between locations are widening, the ability to continuously monitor visitor behaviour is what enables stakeholders to adapt quickly, reduce risk and invest with confidence.

How competition shapes visitor behaviour at a local level

Rather than simply identifying nearby competitors, retailers and real estate players now need to understand how competition actively reshapes catchment areas and redistributes visits across locations.

Visitor Insights makes it possible to analyse how competing assets influence footfall dynamics by revealing where visitors come from, which other brands they frequent, and how visits are shared between locations. This allows retailers to identify not only direct competitors, but also complementary brands that attract similar customer profiles.

By analysing the behaviour of competitors’ visitors, decision-makers can determine which brands drive traffic, which locations overlap in their catchment areas, and where cannibalisation may occur within their own network. These insights support more informed decisions around store openings, relocations and portfolio optimisation, helping businesses position themselves strategically within competitive commercial ecosystems rather than in isolation.

The future of shopping centres: from retail destinations to mixed-use hubs

The future of shopping centres is increasingly shaped by changing visitor behaviour and evolving usage patterns. According to recent analysis by Kearney, commercial real estate is becoming customer-centric not by relying on traditional anchor tenants, but by responding to how people actually use physical spaces.

Shopping centres and retail parks are progressively transforming into mixed-use destinations, combining retail with services, leisure and everyday amenities. Many now function as local hubs, integrating sports facilities, healthcare services, administrative functions and dining alongside traditional retail offers.

Understanding the demographics of surrounding populations is no longer sufficient. What matters is how visitors engage with these spaces on a daily, weekly and monthly basis. Monitoring visit frequency, dwell time and peak hours allows shopping centre managers to identify underperforming time slots, assess tenant relevance and adapt the tenant mix to real demand. By analysing visitor profiles and mobility patterns, landlords and retailers can ensure their commercial spaces attract the right audiences, remain relevant over time and adapt quickly to shifts in consumer behaviour.

To resume

Mobility data helps retailers understand visitor behaviour by revealing who visits a location, where visitors come from, how often they return and how long they stay. By continuously monitoring footfall, dwell time and visit patterns, retailers gain a real-time view of how commercial spaces are used, how behaviour evolves over time and how emerging trends can be identified early, often before changes are visible in sales or occupancy data.